Cantonese Cat argued that Dogecoin is still structurally poised for a late-cycle rally that follows the pattern of previous crypto bull markets, and argued that a decisive move for the coin has yet to arrive. In a 50-minute market analysis published on October 19, analysts tied Dogecoin's configuration to liquidity cycles and intermarket signals, but emphasized that their view of Dogecoin is simple. The market has yet to see the characteristic Dogecoin breakout that coincided with Bitcoin's eventual acceleration in past cycles.

“Every time Bitcoin goes up, Dogecoin also forms a pretty decent base,” he said, noting that while Bitcoin is going up, Dogecoin is only a small participant. In his view, the trigger is clear. “When Doge hits an all-time high… it can happen in a hurry… When Doge hits an all-time high, that’s usually when Bitcoin’s acceleration phase begins.” He frames this relationship as a recurring feature of cycle dynamics, rather than an exception, and argues that the absence of an all-time high breakout for Dogecoin is one of several reasons why he rejects the hypothesis that the broader cryptocurrency cycle has already ended.

Will Dogecoin bull stocks run out of control?

Although the Cantonese cat evokes the broader context of risk appetite and liquidity, he repeatedly narrows the lens to DOGE itself. He characterizes the recent price movement as a period of exhaustion punctuated by rapid deleveraging “with a big core…last week,” hardening bearish sentiment without invalidating the long-term structure. “Doge has yet to break out of an all-time high… There have been deleveraging events, but it has yet to break out of an all-time high,” he said, adding that the coin's fundamental formation is consistent with how the early cycle unfolded prior to the rapid rally.

Part of his belief stems from how he reads Bitcoin's dominance and the timing of altcoin rotations. He argued that the dominance has been going on for “2022, 2023, 2024 and most of 2025” and is looking “a bit tired” and leveling off for about a year. In his framework, declining dominance does not necessarily mean Bitcoin's weakness. Rather, it will mean outperforming altcoins.

“If we end the cycle here… this will be the first time there was no rotation from Bitcoin to altcoins, there was no parabolic phase, but this time it will be different.” He clarified that he does not buy into the “this time is different” theory, saying, “I don’t think this cycle will be any different from the last one… because things are still going on.”

Related books

The point specific to Dogecoin is that the market's recent stress does not negate his expected historical order. He argues that a coin's characteristic movements usually occur after a long period of compression, often in a compressed window.

“Last time (it happened) within just a few months, and the next thing you know, it's like, what happened,” he recalled, warning that DOGE's acceleration window could open quickly once resistance is gone. This pattern recognition is the basis for his pushback against deep-seated pessimism. “A lot of people are just feeling very bitter about Mr. Doge because this cycle has exhausted everyone,” he said, although he sees that sentiment as typical before a crisis breaks out, rather than evidence of structural failure.

Related books

Cantonese Cat repeatedly emphasizes that he is not giving financial advice and acknowledges that his judgment may be wrong. Still, he returns to the same fulcrum. In other words, Dogecoin does not provide a signature event for a completed cycle.

Until it succeeds or decisively fails, he treats the coin as a coil rather than a conclusion. “The reality is I don't really think the cycle is changing…We haven't experienced a[DOGE]breakout,” he said, summarizing the risk-on bias that fuels his view. In other words, for traders positioning around late-cycle outcomes, his message is that the “Dogecoin moment” is still ahead of the tape, and the bears may be early.

DOGE is a price target

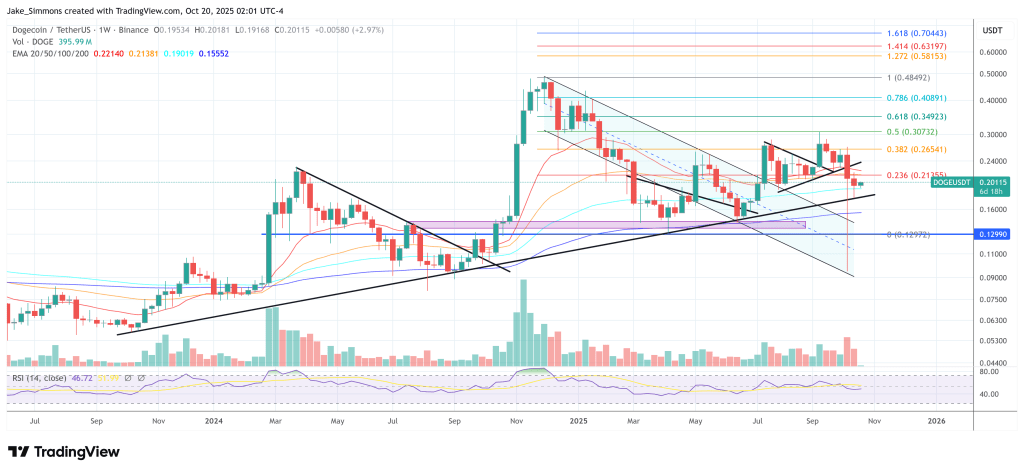

Although the analyst did not mention a new DOGE target in his October 19 video, he adhered to the standards of previous research that provided some frameworks for Dogecoin price targets. In these earlier notes, he claimed that DOGE may be entering the third wave of the Elliott wave structure after reclaiming the 0.618 Fibonacci retracement of the previous impulse ($0.20088).

From that framework, he emphasized upside predictions around $0.48 (1.0 extension), $0.89 ($1.272), $1.23 ($1.414), and $1.96 ($1.618). In various commentary, he also hinted at the possibility of an outcome above $2.00 if the breakout accelerates, and in a more speculative scenario (possibly from another video), he said, “I'm going to lay out my rationale as to why I think DOGE could reach $4 this cycle…”

At the time of writing, DOGE was trading at $0.201.

Featured image created with DALL.E, chart on TradingView.com