Bitcoin “Death Cross” is back in group chats. Yes, the same goes for email. Matthew Siegel, head of digital asset research at VanEck, said he was “getting questions from customers” about the latest mortality crossprint (50-day moving average falling below 200 days), and responded with the kind of data dump that tends to put people off.

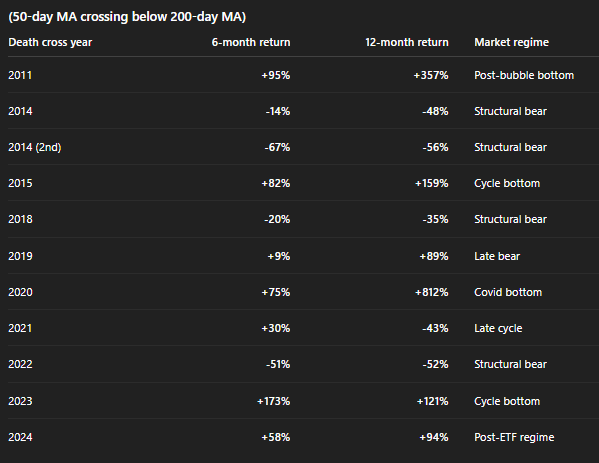

Siegel wrote “lagging indicator” on the X and listed a table of Bitcoin death crosses dating back to 2011. Summary statistics are clean. The median six-month return after a death cross is +30%, the median 12-month return is +89%, and the “positive hit rate” is 64%.

Bitcoin death cross has hit the bottom again?

But it's not just the returns that are interesting. This is Sigel's column on market systems. Basically, it suggests that the same technical signal can mean very different things depending on where you are in the cycle.

We'll take the one tagged as the “bottom” version. In 2011 (the “post-bubble trough”), a death cross appeared around the debris of the early-cycle explosion, which was +357% over the following 12 months. In 2015 (the “bottom of the cycle”) it was +82% in 6 months and +159% in 12 months. This is a typical post-capacity behavior where trend indicators catch up late after the price has already stabilized and started reversing.

Related books

2020 (the “coronavirus nadir”) was an extreme example, with forced liquidations, policy responses, and a monster rebound (+812% in 12 months). And 2023 is also tagged as the “bottom of the cycle”, with +173% in 6 months and +121% in 12 months. Cryptocurrencies have outperformed any asset class in a “this is bad until it's bad” kind of regime.

Next, let's look at “structural bears.” This label has appeared in 2014 (twice), 2018, and 2022. And the forward returns are mostly ugly. 2014 is -48% and -56% in 12 months, 2018 is -35% and 2022 is -52%. The environment is different. There will be less “washouts and bounces” and more “trends are down as the system is deleveraging” – whether it's miners, credit, exchanges, or macro liquidity tightening. In such a regime, the death cross is not a late warning, but rather the moving average confirms that the downtrend is real and persistent.

Related books

The tags in between are also important. 2019 has been marked as “late bearish” with +9% in 6 months and +89% in 12 months, choppy and uneven but improving as the cycle changes. 2021 is the “second half of the cycle.” +30% in 6 months and -43% in 12 months. This is the case in situations where trend signals can change rapidly while distribution and macro tightening creep in.

And 2024 is a “post-ETF regime” with +58% in 6 months and +94% in 12 months. This tag has many effects. That suggests that the context is not just “price versus moving averages,” but a market with structural demand (ETFs), various liquidity piping, and the potential to behave more like a hybrid of trad-fi flows and crypto-native positioning than pure reflex leverage.

So the point here is not that “Deathcross is bullish.” That's not true. That is, most of the signal is a trailing mirror. And the regime we're actually in (bottoming, lagged bearish, structural deleveraging, late cycle, post-ETF flow market) will determine whether it's a fakeout, confirmation, or just noise with a scary name.

At the time of writing, Bitcoin was trading at $86,631.

Featured image created with DALL.E, chart on TradingView.com