Glassnode co-founders Jan Happel and Jan Alleman, who publish X articles under the handle @Negentropic, argue that the current crypto crash is not caused by a shift in the broader narrative, but rather by a single, systematic source of selling pressure, the footprint of which is most pronounced in Bitcoin and is spilling over into the broader complex. Their core argument is adamant that what is happening with Bitcoin right now is not a change in the narrative, but a mechanical unwinding. In that framework, the tape reflects the forced exit of one participant rather than an organic re-pricing of crypto risk.

Why is the virtual currency market crashing?

Negentropic's paper begins by saying that momentum indicators operate in a way that he argues is inconsistent with “natural markets.” They point out that “the 1D MACD just hit a new all-time low, but the price is only 33% down from the high,” and add, “This doesn't happen in natural markets. You only get this if someone is dumping in a straight line.”

They combine that observation with oscillators like capitulation that do not involve regular macro or leverage shocks. As they say, the RSI is nearing capitulation, but “there is no macro stress, no credit shock, no leverage explosion, no ETF outflows.” This discrepancy is important to their conclusions. “It's extreme momentum without a catalyst. It's a typical feature of mechanical sales.”

Related books

They then compare today's settings to previous episodes in which the MACD and RSI reached similar extremes. In these historical cases, “prices fell 60%, derivatives crashed, and funding went significantly negative,” Negentropik said. In contrast, their current interpretation confirms that stress does not exist. “The ETF remains net positive and its cost base remains intact,” they write, emphasizing that “long-term holders are actively reducing supply.”

They also point to resilience among cryptocurrencies, stating that “Solana ETF inflows have been steady and altcoins have held up relatively well compared to Bitcoin and Ether,” and “Ether has fared better than Bitcoin.” For Negentropic, these relative strength signals indicate that this is not a system-wide risk-off event. “If this was a real emotion, everything would break. It's not,” they conclude.

Flow regularity is another pillar of the Glassnode co-founder's case. They describe a pattern that has allegedly been repeated since October 10th. “The same timestamps, the same venue-specific thinness, the same lack of reflexive bidding.” This means mechanical intent rather than discretionary trading. “This is a schedule, not a market,” they wrote, alleging “a consistent influx of toxic substances over a 21-day period.” In their view, this sequence of events is consistent with “an explanation” that “the liquidity provider or fund was structurally damaged on October 10” and that “the entities involved in the failure have been reducing risk in a coercive and rules-based manner.”

Independent tape watchers report surprisingly similar trends. Front Runners (@frontrunnersx) reports that large sellers on Binance are entering the market like clockwork. They say that for “two weeks in a row” the company “always hit the sell button exactly when the U.S. market opens at 9:30 a.m. ET.”

They say that “some type of coherence usually refers to sophisticated actors operating under a specific authority or time frame,” adding that it “appears more like a single entity (or tightly coordinated group) than a random flow.”

Macro analyst Alex Krueger details how that manifests across the venue. He suggested that sellers may be “dumping during U.S. business hours through brokers and OTC desks that employ smart order routing and hedging strategies across multiple exchanges.” In his view, the superiority of Binance prints does not have to originate from Binance. He argues that “that's where most of the liquidity is, so naturally most of the volume will flow there.”

Related books

Krueger also highlights the asymmetry of venues fitting into the routing flow story. While he sees “relatively low spot sales via Coinbase this week,” he notes that “spot sales via Bitfinex are at an unusual level.”

Will the virtual currency collapse last long?

Tommy Shaughnessy, founding partner at Delphi Ventures, focuses on the urgency implied by pace. If this trend had existed since October 10th, “the speed at which BTC would be sold would be pretty crazy,” he wrote. He interpreted this as coercion rather than strategy, saying: “It means they are price insensitive and need to exit quickly.” Shaughnessy characterizes the move as “violent,” but adds an important qualifier consistent with Negentropic's limited distributor framework. It will probably be short-lived because there is no order.

If a 10/10 entity exists, the speed at which they sell $BTC is pretty crazy

This means they are price insensitive and need to exit quickly. (Someone had a graph of all red candles for several days)

It's violent, but the lack of order means it's hopefully short-lived https://t.co/kaJAKh5Z4M

— Tommy (@Shaughnessy119) November 21, 2025

Multicoin Capital founder Tushar Jain similarly explains what is considered a forced liquidation act. “It feels like there is a massive sell-off in the market,” he wrote, adding, “We are seeing organized sell-offs occurring at certain times of the day.” Jain clearly linked this to the same October window negentropic flag, calling it “probably the result of a 10/10 liquidation” and saying, “It's hard to imagine a forced sale of this scale lasting much longer.”

He also placed this moment within a longer process of monetary easing and recalled lessons from previous cycles. “After such a large liquidation flash, it will take time for all the bankruptcies to become clear,” as “stores scramble to understand what their exposure to bankrupt counterparties is.”

It feels like there's a big push on the market. Organized sales are held at specific times. Probably the result of 10/10 liquidation. It is hard to imagine forced sales of this scale continuing much longer. https://t.co/JO6kRmJUUb

— Tushar Jain (@tushar_jain) November 19, 2025

Taken together, these sources present an internally consistent and consistent view. In other words, the downside of cryptocurrencies is dominated by a single, time-boxed, price-insensitive seller whose execution patterns are systematic enough to distort momentum indicators and intraday structure.

Negentropic's conclusions are not merely descriptive, but also interpretive. “This is not a capitulation. This is not a trend break.” Rather, it is a “constrained unwinding through a fragmented market.” And since mechanical sellers will also end when inventories and obligations end, the Glassnode co-founders argue that by then “the recovery is likely to be much steeper than the previous decline.”

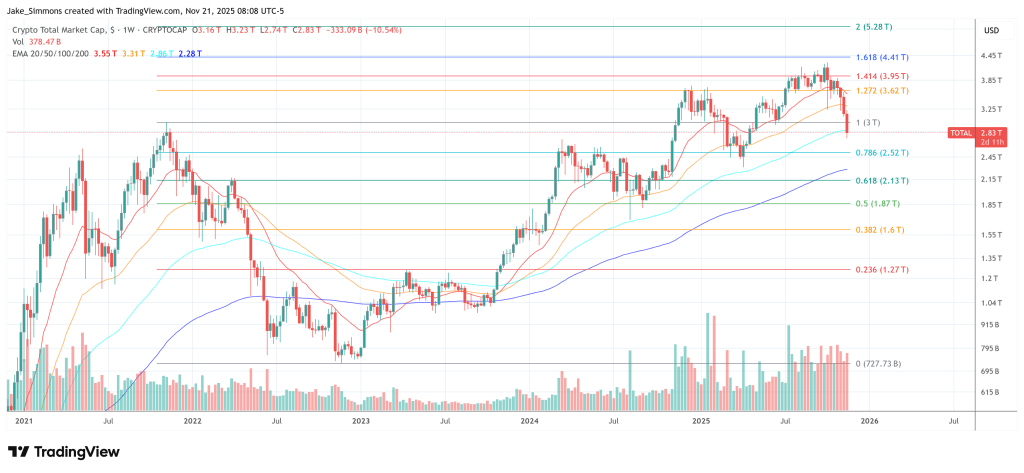

At the time of writing, the market capitalization of cryptocurrencies was $2.83 trillion.

Featured image created with DALL.E, chart on TradingView.com