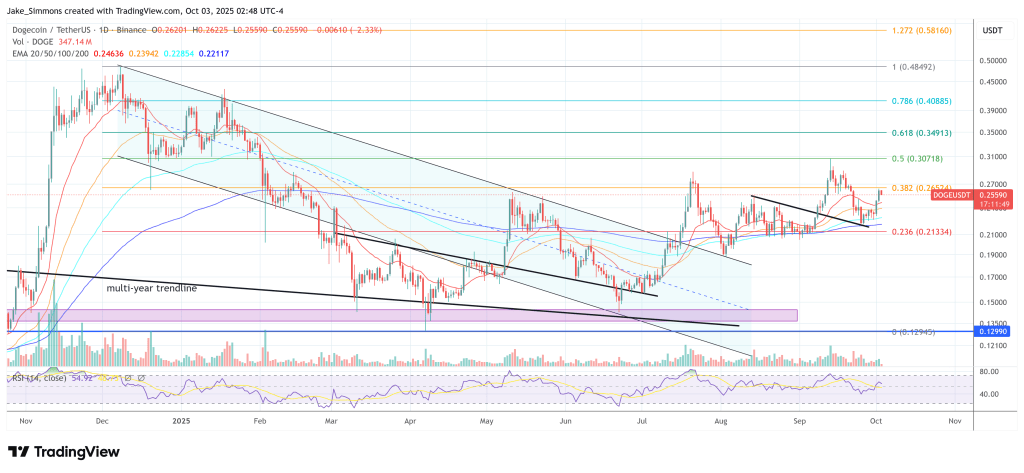

According to Trader Incomesharks, Dogecoin's daily charts are caught up in technically clean inflections. Traders have posted Rising Channels and Balance Volume (OBV) wedges that map simple routes to a higher level. “Doge – not a bad setup. Clear channels and clear OBV wedges. Ideally escape before the price,” the analyst wrote, sharing a chart assembled the current advance.

Dogecoin Breakout Watch: Deck with $0.33 trigger

Price respects well-defined upward channels that have dominated trade since early summer. Multiple touches on both boundaries validate the structure. Higher lower prices along the bottom of the trendline from July to early October, and lower rejections for the upper rails through mid-July, late August and late September.

After a fresh rebound from the rising support area at the beginning of October, Doge is pushed back into the midrange of the channel, usually pausing before the next impulse. Incomesharks' pass sketches assume short integration or shallow pullbacks within the channel, followed by a drive towards the ceiling.

Related readings

Destinations are explicit in the chart. Currently, the upper boundary crosses at $0.30, between $0.30 and $30 in medium, with the drawing showing breakout attempts between about $0.32 and $0.33. That zone represents confluence. That's where upward channel resistance was generated and supply in late September limited previous thrust. The decisive daily closing through that band confirms the bullish channel breakout, running in early December 2024, leaving the door open for $0.4843.

Volume Dynamics is Tell To Watch. The lower panel plots the obv, a cumulative measure of buy/sell pressure, and was compressed into symmetric wedges. This type of reduction range often precedes an expansion of direction.

Related readings

Incomesharks' comments highlight that the sequence: OBV breakout before price shows a new accumulation and improves the odds that continue with prices on pushing to the top of the channel. Conversely, an OBV failure in wedge support would warn that there is a lack of sponsorship in the rebound, increasing the risk of another testing of lower channel lines.

Structureally, it's easy to set up. Since July, the path of minimal resistance remains within the channel as long as Doge continues to retain its support for the rising trend defined. Its wedge-clean oblivulbreak enhances its view.

If Bulls can clear overhead supply and convert bands between $0.32-$0.33 to support, the chart will check the review of the breakout roadmap Incomesharks outlined. Instead, if the price loses a base that increases, the channel paper will be invalidated and the market may revisit higher and lower areas along lower rails before attempting another trend leg.

At the time of pressing, Doge traded for $0.2559.

Featured images created with dall.e, chartfrom tradingview.com