Ethereum has regained the $3,150 level after a volatile run, showing a rare sign of strength in an uncertain market. The broader cryptocurrency landscape remains highly divided. While some analysts argue that ETH and the rest of the market are still facing a continued decline and could reach new regional lows, others believe that this correction is simply a reset before a larger bullish cycle that will likely continue until 2026.

Related books

But there is one signal that stands out clearly among the noise. That means a bunch of smart whales are going long ETH all at once. On-chain data shows that some of the most profitable and stable whale traders (each with realized profits in the tens of millions of dollars) have opened substantial long positions totaling over hundreds of millions of dollars. Their concerted action shows confidence that Ethereum’s recent lows represent opportunity rather than danger.

This alignment between top-performing whales provides a compelling counterpoint to the bearish narrative. Although retail sentiment remains fragile, the most sophisticated market participants appear poised for even bigger moves ahead. As Ethereum stabilizes above $3,150, the question becomes whether the whales will be proven guilty early or whether they are right.

Top performers put stress on Ethereum

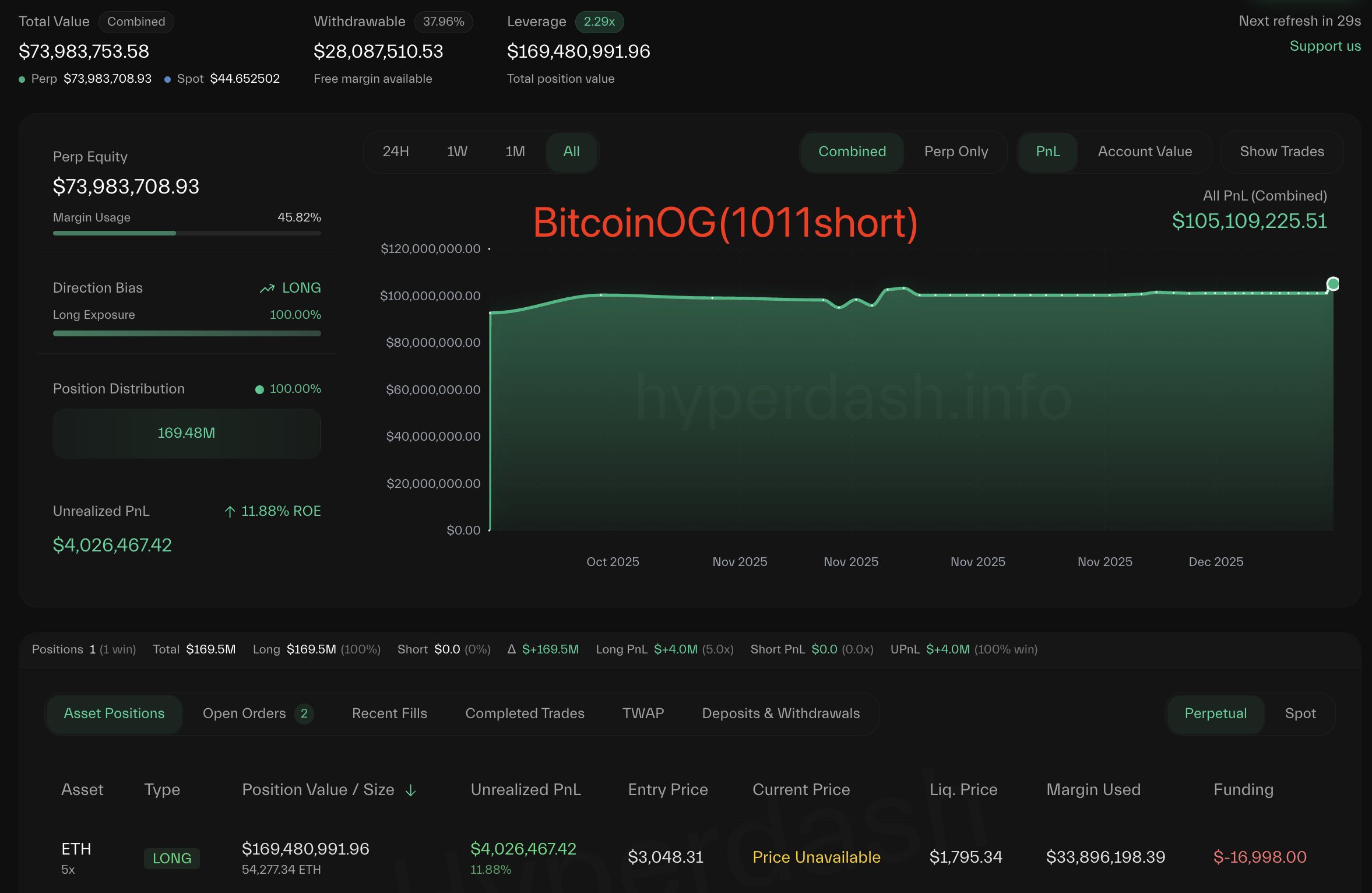

According to Hyperdash data shared by Lookonchain, some of the most successful and influential whales in the market are actively accumulating Ethereum, sending a strong signal that high-conviction players are looking for further upside.

One of the most notable is BitcoinOG. He is a widely known trader who shorted the market during the October 10th crash, a move that gave him a lot of credibility. With a total realized P&L of $105 million, BitcoinOG currently holds 54,277 ETH worth approximately $169.48 million, firmly positioned on the bullish side.

Another major player is the famous anti-CZ whale, named after Binance founder Zhao Changpeng's historical pattern of taking the opposite side of his preferred positions. With an impressive total P&L of $58.8 million, this whale currently has a long position of 62,156 ETH, which is a massive $194 million position. His trades often provide an early indication of the market's broad direction, lending weight to the transition to bullish exposure.

Finally, pension-usdt.eth is a consistently profitable whale address with $16.3 million in realized profits, worth $62.5 million long with 20,000 ETH.

Taken together, these positions reflect a unified stance among top-performing whales. Despite market uncertainty, they are positioning themselves for the strength of Ethereum.

Related books

Weekly structure shows early signs of stabilization

Ethereum’s weekly chart reveals that the market is trying to regain its footing after weeks of plummeting from the $4,500 region. The recent recovery to $3,150 is a meaningful development as this level closely aligns with previous weekly support from mid-2024 and sits just above the 50-week moving average, an area that often serves as a trend-defining zone. ETH briefly fell below this region during the November selloff, but buyers intervened aggressively, creating a strong weekly core indicating demand at lower levels.

Despite this recovery attempt, ETH remains below key resistance levels. The 20-week and 100-week moving averages are converging above the current price, creating a potential rejection zone unless momentum strengthens. For now, ETH is trading in a transitional structure. Although there is no longer an active downtrend, we have not yet seen a bullish reversal on the higher time frame.

Related books

Volume patterns also support this interpretation. Although selling volume has decreased compared to the capitulation phase, recent green candlesticks indicate moderate but steady buying interest, suggesting accumulation rather than full risk-on behavior.

If ETH can establish consecutive weekly closes above $3,200-$3,300, the chart opens the door to retest the $3,600-$3,800 range. However, if $3,150 cannot hold, there is a risk of another move towards the $2,800 support.

Featured image from ChatGPT, chart from TradingView.com