Bitcoin rallied on new purchases from large holders, but smaller wallets appear to have booked profits, a pattern that on-chain watchers see as supporting further gains.

Related books

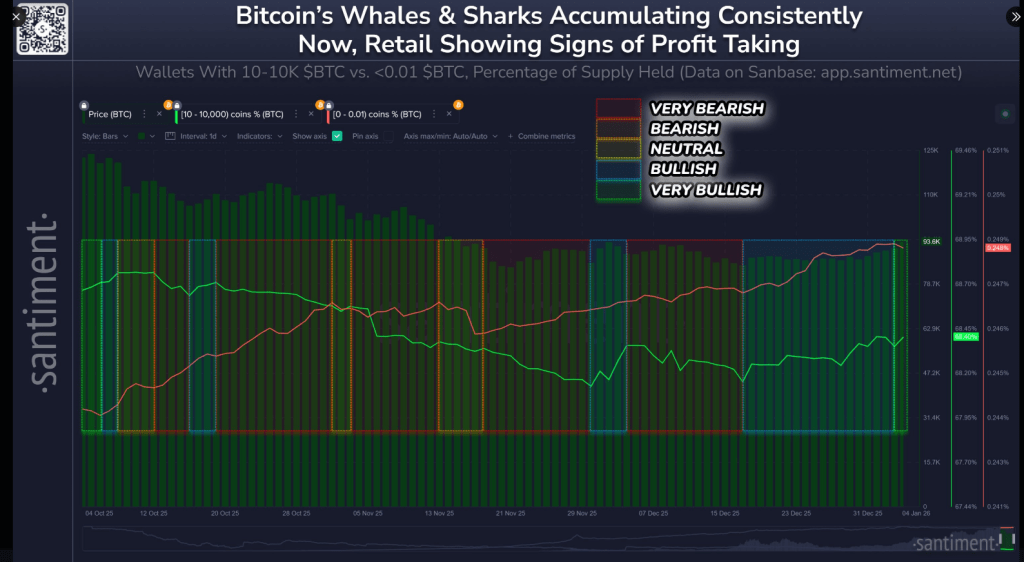

Whale accumulation and retail profit taking

According to Santiment, wallets holding between 10 and 10,000 BTC (described as whales and sharks) have added 56,227 BTC since mid-December. At the same time, wallets with less than 0.01 BTC are taking profits, suggesting that some retail traders are expecting a bull trap or a rally of fools.

This split, i.e. large accumulations by large holders while small accounts are sold off, increases the likelihood that the overall market capitalization of cryptocurrencies will increase.

Supply reallocation and market structure

Market players say supply is changing in a way that supports price trends. Analyst James Cech said the top-heavy supply share has fallen from 67% to 47%, a significant move in a short period of time.

📊 Cryptocurrency markets typically follow the path of major stakeholders: whales and sharks, moving in the opposite direction from small retail wallets. In the graph below:

🟥 Whale dumping, retail increase (very bearish)

🟧 Whale dumping, retail is unpredictable (bearish)

🟨Whale and retail… pic.twitter.com/yoC0H1keBT— Santiment (@santimentfeed) January 5, 2026

This shift, combined with reduced profit-taking and signs of a futures short squeeze, has supported price gains despite low overall leverage.

Bitcoin had been trading in a range between $87,000 and $94,000 for about six weeks, but it briefly hit a seven-week high of $94,800 on Coinbase in late trading on Monday.

Options and key levels

Traders keeping an eye on option rates are expecting call activity to pick up around the $100,000 exercise, which expires in January. According to the data, Bitcoin is in a bullish consolidation phase, with immediate resistance seen between $95,000 and $100,000, and support placed around $88,000 and $90,000.

A clean break above the upper zone could push prices higher, while a break below the lower zone could lead to deeper selling pressure.

Geopolitical shocks and trading volumes

Bitcoin hit a multi-week high on Monday, trading above a key level near $93,000, after Venezuelan President Nicolas Maduro was reportedly detained by the US military.

Analysts have linked the move in part to geopolitical uncertainty pushing some investors toward alternative assets. Speculation about Venezuela's alleged large holdings of BTC (reportedly hundreds of thousands of coins) also spurred market noise and trading activity.

Overall, this event did not directly drive Bitcoin's fundamental value, but coincided with an increase in volatility and volume, reflecting a broader market reaction to global tensions.

Related books

What this means for traders

The current combination of large-scale buying and individual profit-taking has created a skewed market bias. If the whales continue to accumulate, an upward breakout becomes more likely. However, the decline in retail prices warns that a short-term reversal remains possible.

The $95,000 to $100,000 range appears to be a key area for a potential breakout, while support near $88,000 to $90,000 could impact sentiment if the price falls below that.

Reports and on-chain data suggest that momentum is leaning towards further upside, although the market may remain volatile as traders react to both technological levels and geopolitical developments.

Featured image from Unsplash, chart from TradingView