Key Takeaways

Bitcoin and altcoins dropped after weak US jobs data heightened recession concerns.

Markets anticipate a Federal Reserve rate cut in September as economic risks increase.

Share this article

The price of Bitcoin fell below $110,500 on Friday morning as August jobs data came in weaker than expected, which fueled concerns about a looming recession. Altcoins also saw gains erased as market volatility intensified.

The US economy added 22,000 jobs in August, far below expectations and down from 79,000 in July, the Bureau of Labor Statistics reported. The unemployment rate increased to 4.3% from 4.2%, while July’s job gains were revised lower from 73,000.

The sharp deceleration suggests businesses are pulling back on hiring, often an early warning sign of weaker demand and slowing activity.

The three-month average has dropped sharply, showing a consistent cooling trend in the labor market that can spill into consumer spending and overall growth, raising the risk of recession.

Gold hit a record $3,580 on the weak jobs data, while Bitcoin dipped to $112,500 before rebounding above $113,300, TradingView showed.

The Dow, S&P 500, and Nasdaq also touched fresh highs, but crypto and equities quickly pulled back even as markets fully priced in a September Fed rate cut.

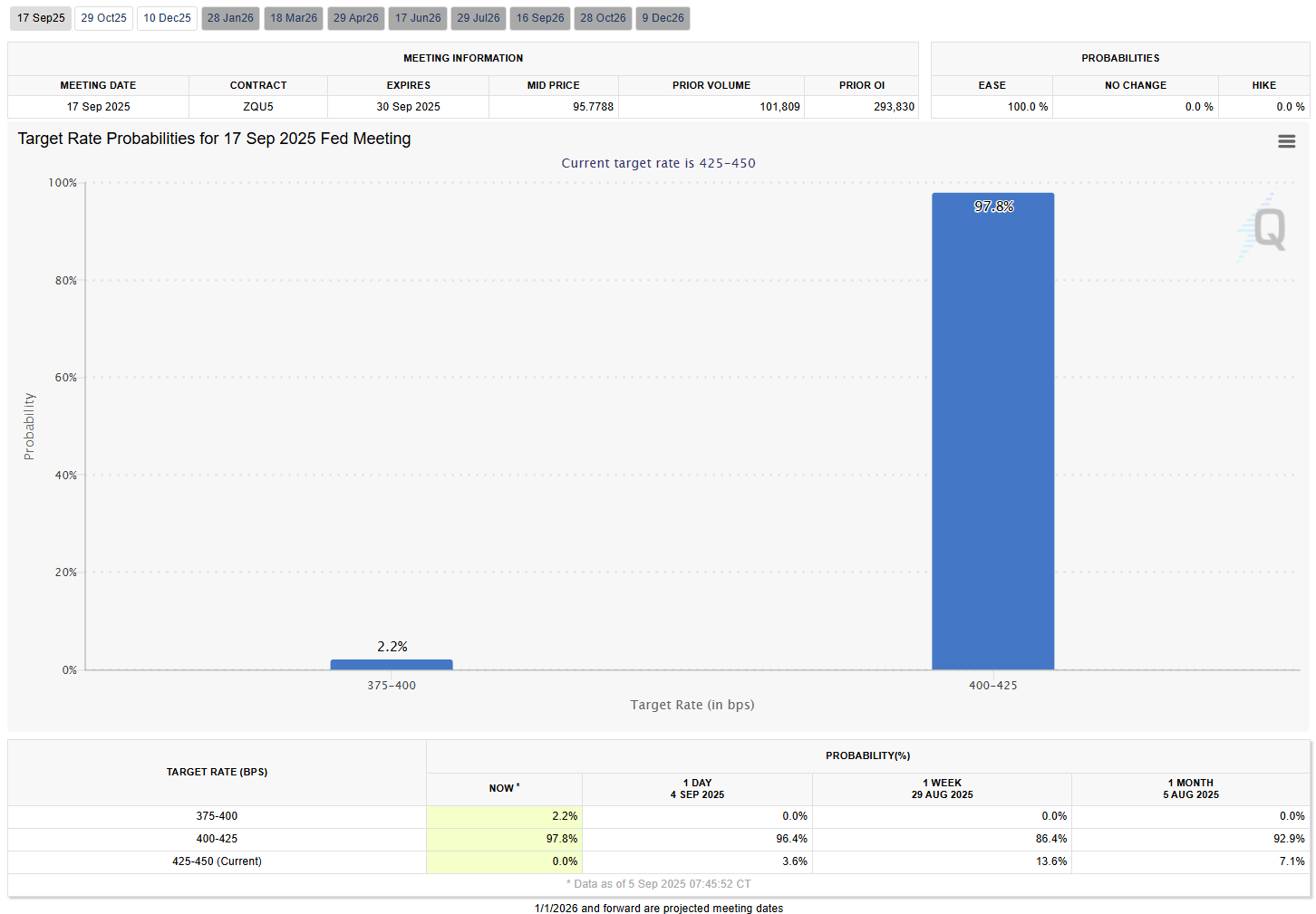

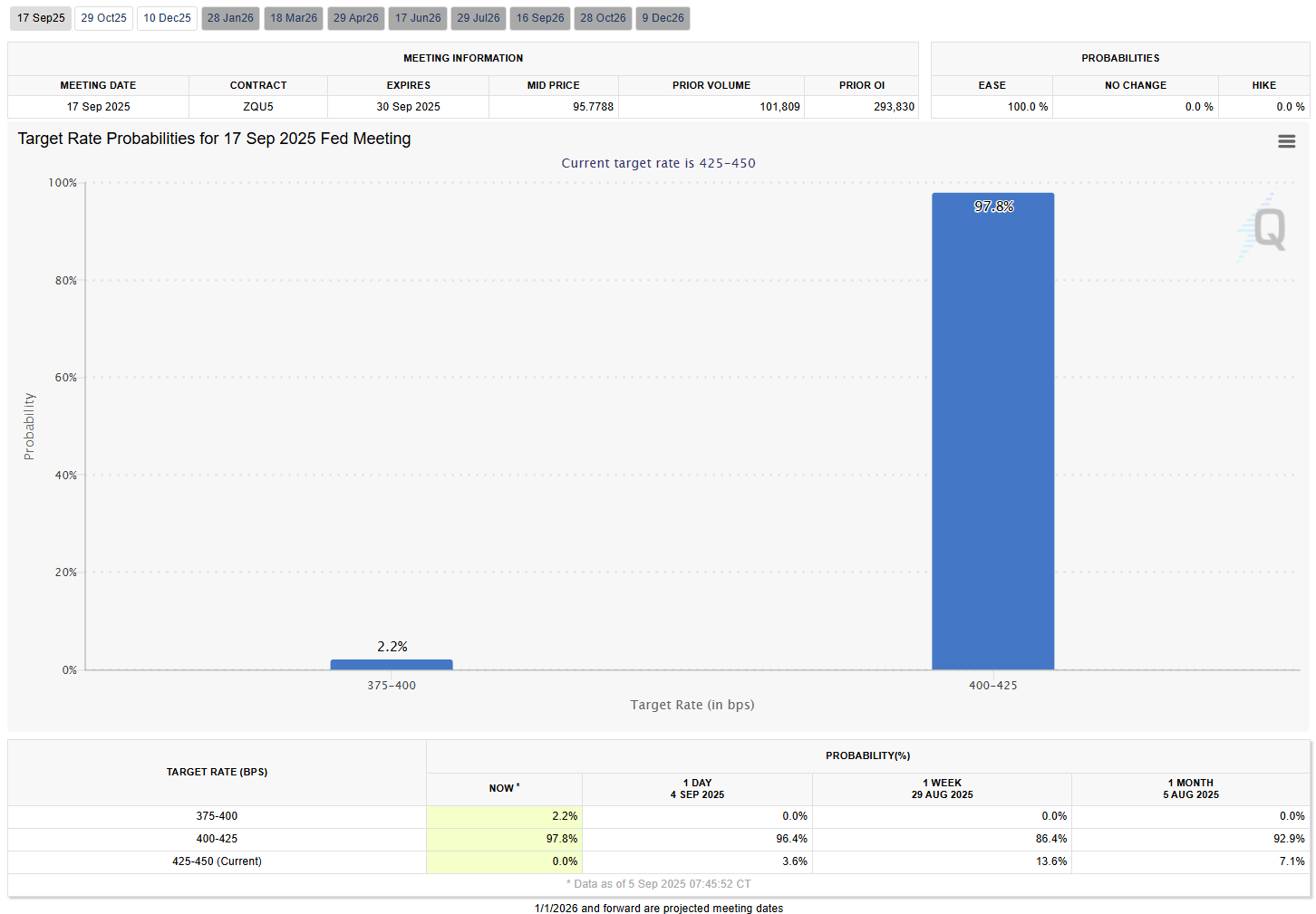

Traders now see a 98% chance the Fed delivers a quarter-point cut at its Sept. 16–17 meeting, with 2% odds on a half-point move, according to FedWatch Tool data.

In his most recent statements at the Fed’s Jackson Hole event, Fed Chair Jerome Powell signaled that the central bank kept the door open for a September rate cut.

However, he also indicated it would not signal the start of an aggressive easing cycle.

Powell noted that inflation risks remain tilted to the upside while employment risks are leaning lower. With policy rates now closer to neutral but still restrictive, he said the Fed can proceed carefully, while leaving room for adjustments if risks shift further.

Markets are now looking ahead to the August Consumer Price Index (CPI) data, set for release on September 11, to gauge whether Fed rate cuts are on the horizon.

September has historically been a volatile month for crypto and stocks.

Last year, Bitcoin fell below $55,000 before surging after a 50-basis-point Fed cut. The rate move came amid rising unemployment, weak job growth, and recession fears.

Share this article