Dogecoin is trending along a technical fault line near the low $0.10 area, with traders eyeing a tight support band that could determine whether DOGE stabilizes or falls into a structurally weak regime.

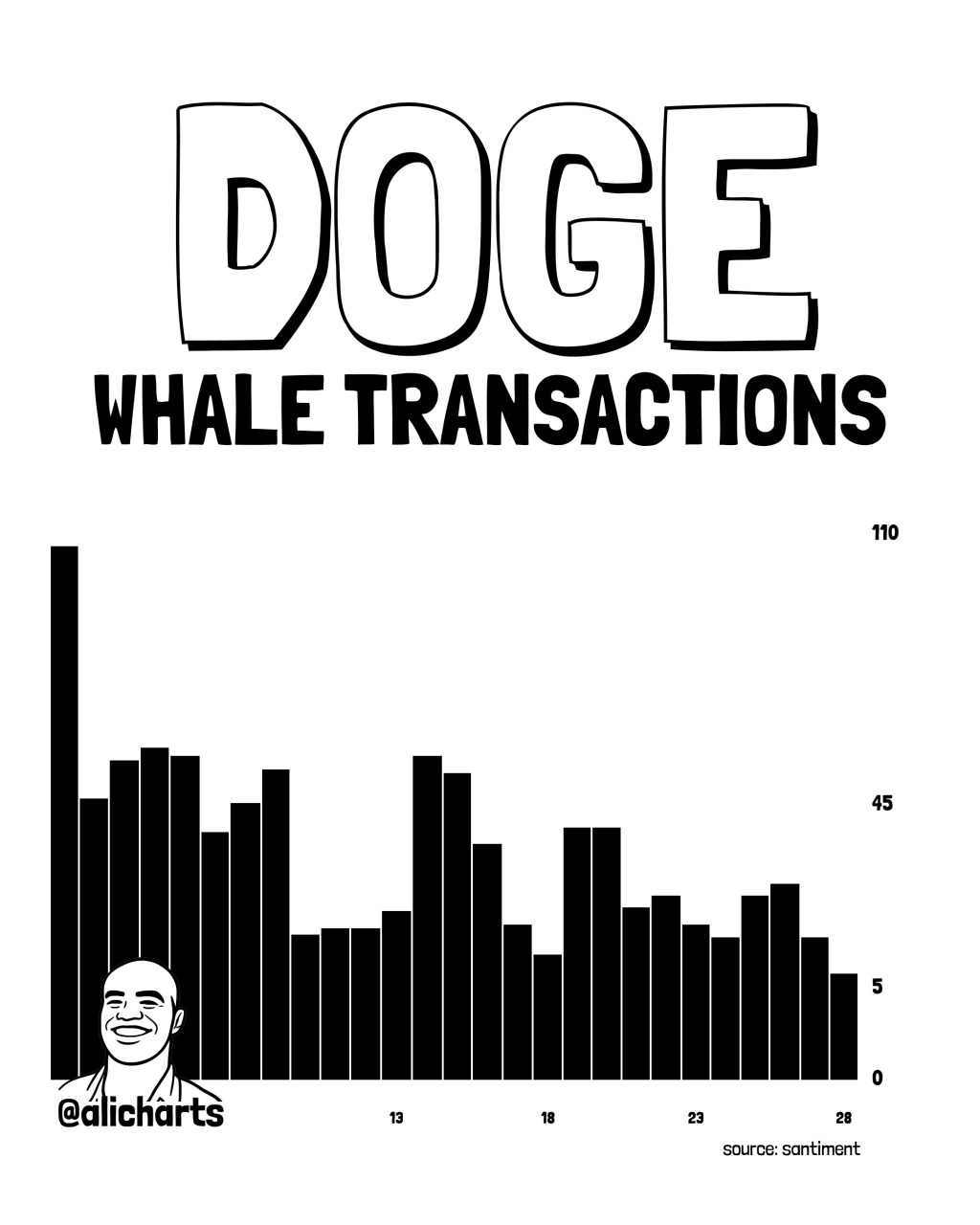

Even though on-chain whale activity appears to be rapidly declining, the immediate setting is framed by chart-focused accounts as a high-confidence “line in the sand.” Ari Chart said that transactions over $1 million on the Dogecoin network “have fallen 94.6% over the past four weeks, from 109 to just 6,” noting a sharp decline in high-value transactions over the same period that DOGE has been seeking assistance with.

This needs to be the bottom price for Dogecoin

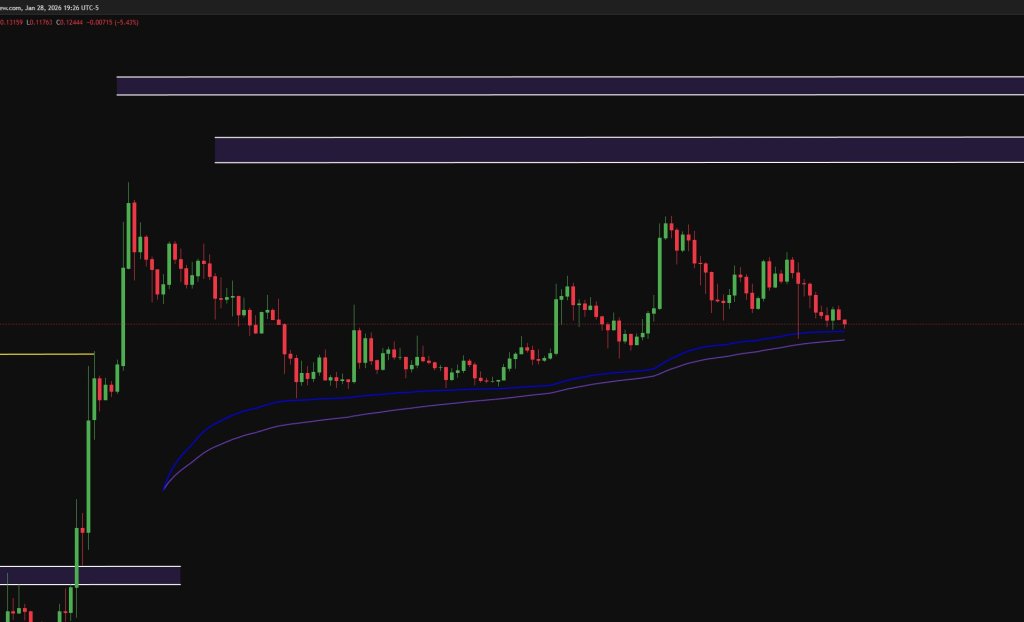

Kevin (@Kev_Capital_TA) argued that DOGE is currently on top of long-term trend support that typically receives systematic attention. “Want to see the all-important chart? Dogecoin is currently sitting at the top of the 2W 200 EMA/SMA, which is also a major structured support zone. The .12-.10 zone is all about it,” he wrote.

Related books

“If there was ever a place we wanted to see the bottom come, it is in that zone. If not, things become structurally very risky. Performance, as always, depends entirely on BTC.”

This framework is important because it ties the deal to two separate terms. Namely, DOGE maintains a defined price shelf and Bitcoin avoids a broader risk-off move that could force an unwinding of correlation trades. In other words, even a “clean” DOGE level may not be able to sustain itself if BTC declines.

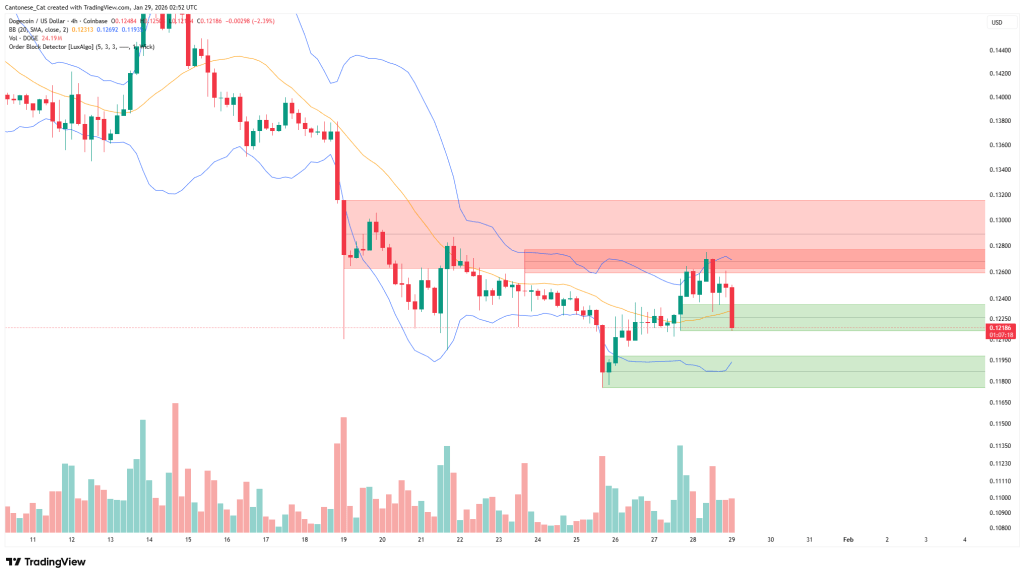

The short-term chart shared by Cantonese Cat (@cantonmeow) also leans towards the same battleground. The account posted a view of the 4-hour Bollinger Bands, highlighting that it has pushed the local level into what it describes as a buy-side zone. “We're breaking through to the buy order block below with low volume,” Cantonese Cat wrote today, adding, “Looking to buy DOGE tonight.”

The chart shows that DOGE is below the midline of the 4-hour Bollinger Bands. Therefore, the price is likely to move back towards the lower band around $0.12, an area that overlaps with the support zone that Kevin flagged. A full break below this cluster would shift the setting from “defensive support” to “lower continuation risk,” and more serious downside potential would re-emerge.

Related books

Cantonese Cat also posted a macro comparison of DOGE and DXY on January 28th, suggesting that the broader context could reflexively move higher if conditions are right. “The macro environment is favorable for DOGE's rise,” the account wrote. “So either DOGE is not practical and will never be seen again, or history will repeat itself.”

It's a stark binary, but it captures the tension DOGE traders face. Memecoins can be traded as pure liquidity beta when the macro environment eases, but the market could also punish assets that struggle to sustain new demand once speculative impulses subside.

The next move will likely depend on whether DOGE is able to defend the $0.10-$0.12 range while regaining participants, either through an influx of new large holders or increased risk appetite led by BTC. If this floor holds, traders will be positioning for a bottoming process and a squeeze back into overhead supply.

At the time of writing, DOGE was trading at $0.121.

Featured image created with DALL.E, chart on TradingView.com